- Need help call : +919607794222

-

- info.smecare@gmail.com

- FREE CONSULTATION

-

The scheme will be effective from the date of 13/01/2016 to 31/03/2022.

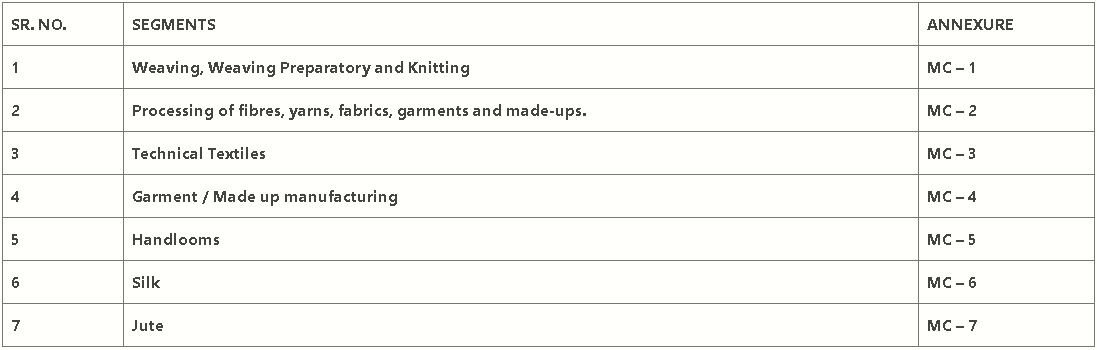

List of eligible machinery for the following segments were finalized.

| SR. NO. | SEGMENTS | ANNEXURE |

| 1 | Weaving, Weaving Preparatory and Knitting | MC – 1 |

| 2 | Processing of fibres, yarns, fabrics, garments and made-ups. | MC – 2 |

| 3 | Technical Textiles | MC – 3 |

| 4 | Garment / Made up manufacturing | MC – 4 |

| 5 | Handlooms | MC – 5 |

| 6 | Silk | MC – 6 |

| 7 | Jute | MC – 7 |

DEFINITION OF TECHNOLOGY UPGRADATION

Technology Upgradation would mean induction of state-of-the-art or near-state-of-the-art technology. But in the widely varying mosaic of technology obtaining in the Indian textile industry, at least a significant step up from the present technology level to a substantially higher one for such trailing segments would be essential. Accordingly, technology levels are benchmarked in terms of specified machinery for each sector of the textile industry. Machinery with technology levels lower than that specified will not be permitted for funding under the TUF Scheme.

TYPE OF TEXTILE MACHINERY ELIGIBLE

Under the TUF Scheme, only new machinery will be permitted.

Accessories / attachments / sample machines / spares received along with the machinery upto the value of 20% of the machinery cost eligible under A-TUFS or actual value whichever is lower will be eligible.

Advance / token payment up to the margin money for machine cost can be paid by the unit prior to the date of sanction of term loan. However, machines purchased on or after date of sanction of term loan will be eligible under A-TUFS subject to fulfillment of other terms and conditions.

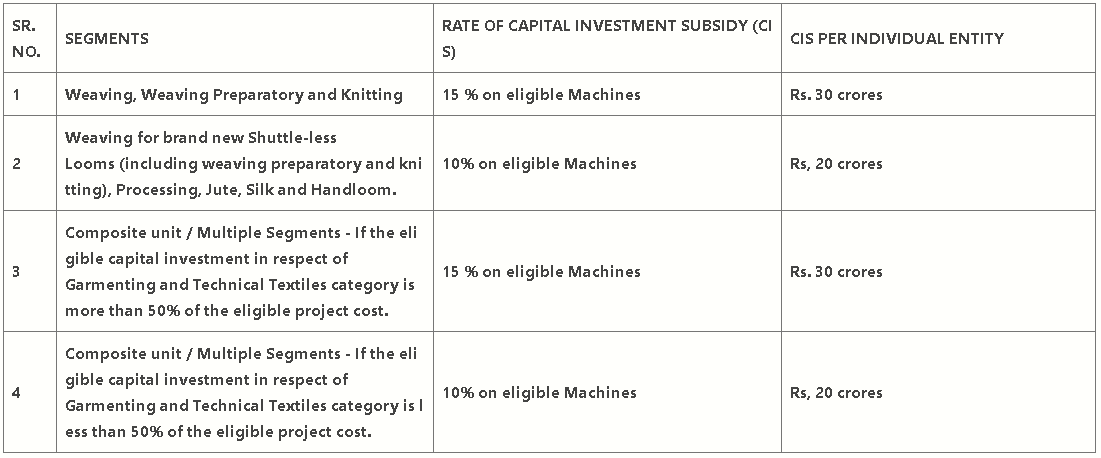

| SR. NO. | SEGMENTS | RATE OF CAPITAL INVESTMENT SUBSIDY (CIS) | CIS PER INDIVIDUAL ENTITY |

| 1 | Weaving, Weaving Preparatory and Knitting | 15 % on eligible Machines | Rs. 30 crores |

| 2 | Weaving for brand new Shuttle-less Looms (including weaving preparatory and knitting), Processing, Jute, Silk and Handloom. |

10% on eligible Machines | Rs, 20 crores |

| 3 | Composite unit / Multiple Segments - If the eligible capital investment in respect of

Garmenting and Technical Textiles category is more than 50% of the eligible project cost. |

15 % on eligible Machines | Rs. 30 crores |

| 4 | Composite unit / Multiple Segments - If the eligible capital investment in respect of

Garmenting and Technical Textiles category is less than 50% of the eligible project cost. |

10% on eligible Machines | Rs, 20 crores |

In case the applicant had availed subsidy earlier under RRTUF, he will be eligible for only the balance amount within the overall ceiling fixed for an individual entity.

The Government has constituted a Technical Advisory-cum-Monitoring Committee (TAMC) under the Chairmanship of Textile Commissioner with technical experts from government and industry covering the different segments, as members. The composition and functions of TAMC are

Amendment in the list of machinery in terms of addition / deletion will be done by the TAMC.

If any question of interpretation or clarification is raised by the lending agency / entrepreneurs as to the eligibility of any unit or machinery under the scheme, the decision of the TAMC will be final The TAMC will also monitor and review the progress of the scheme and apprise the Ministry and IMSC periodically.

The IMSC under the Chairmanship of Minister of Textiles would review the scheme and ensure compliance of the subsidy cap.

LINK: Government Resolutions